Intelligent Chargeback Defense

End-to-End Chargeback Management & Fraud Prevention

Reduction in Chargeback Ratios

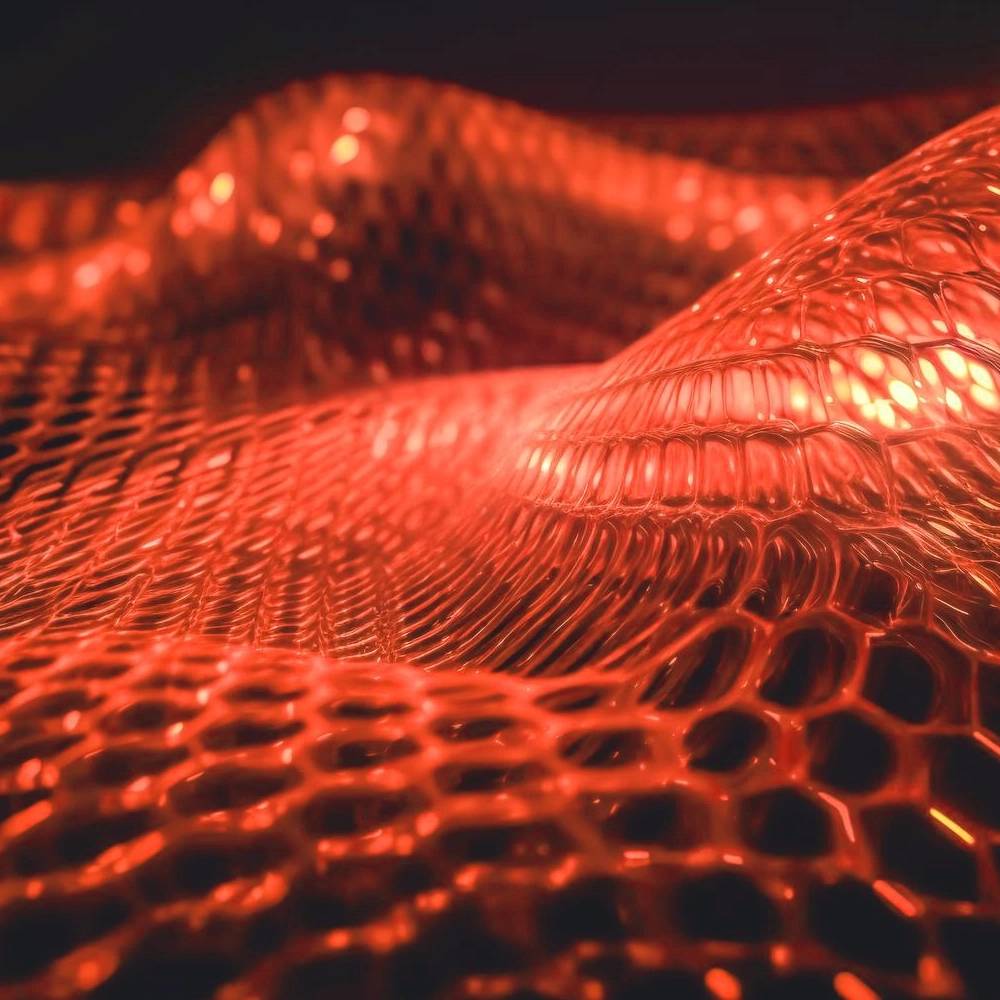

Safeguard your revenue with our unified dispute management platform. We combine automated pre-dispute resolution with advanced fraud analytics to intercept inquiries before they become chargebacks. Our system integrates seamlessly with global issuer networks, allowing you to share real-time order details and resolve disputes instantly, keeping your merchant accounts healthy and secure.

Comprehensive Payment Protection & Dispute Management

Automated Pre-Dispute Resolution

Order Insight Integration

Strategic Dispute Representment

AI-Driven Fraud Protection

Real-Time Risk Analytics

Seamless API Integration

End-to-End Payment Protection

Frequently Asked Questions

Our system integrates with issuer collaboration networks. It allows you to set custom rules (e.g., by amount or reason code) to automatically refund a transaction instantly, preventing it from becoming a chargeback.

Absolutely. We adhere to strict data protection standards (GDPR/CCPA). Transaction data is encrypted and only shared with authorized card networks and issuers for the purpose of dispute resolution.

While no solution can stop 100% of chargebacks, our clients typically see a significant reduction (often 30-40%) in their dispute ratios by utilizing automated decisioning and early alerts.

With our flexible API and plugins for major platforms, most merchants can go live within 1 week to 2 weeks after the verification process.

.png)